By Tatiana Compton, Phoenix Frontiers, and Caroline VIsser, Global Road Links

Sustainable infrastructure is rapidly gaining traction with investors. The consideration of environmental, social and governance (ESG) aspects is central to the delivery of high-quality sustainable infrastructure, construction and transport projects everywhere. Forward-looking companies in the sector are already placing it at the core of responsible delivery. ESG standards are not just a road from A to B, but rather a road journey to improve working conditions, strengthen communities, and make roads safer and less environmentally intrusive.

In the last few years, ESG factors have risen to the forefront of the corporate agenda. This shift is largely due to the growing demands for greater transparency from consumers, voters, activists and investors, and the increasing regulatory and litigation risks associated with ESG, as the number of ESG-related hard laws continues to proliferate.

As investor demand for climate and other ESG information soars, the United States’ Securities and Exchange Commission (SEC) is responding to government and societal pressure by currently preparing regulation to be introduced in 2022 to make ESG reporting mandatory for all public traded companies. It is expected that in early 2022, the SEC will issue a proposed climate change disclosure rule for public comment with required reporting likely to begin in calendar year 2023. This movement towards more government oversight and regulatory compliance is already well under way in the European Union – where two significant ESG-related regulations have already been passed: the regulation on sustainability- related disclosure in the financial services sector (SFDR) in 2019 and the Taxonomy Regulation in 2020. US regulators are set to follow the EU’s lead.

A need to respond

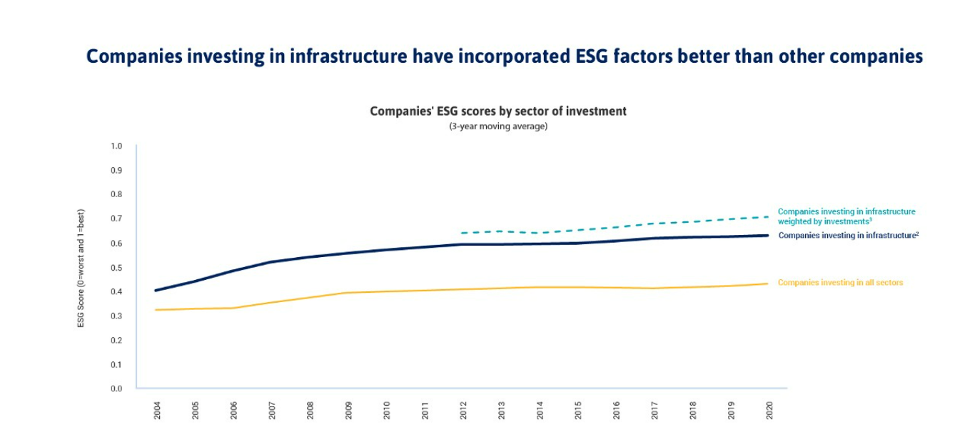

As societal pressure, as well as client, and employee expectations, are growing for ESG, companies and project sponsors must ask themselves this question: how will we respond? The challenge for transport infrastructure companies is to meet this growing demand for ESG disclosure. However, an ESG-conscious approach to transportation investing should be viewed as an opportunity to create return as opposed to a risk to manage. A staggering US$90 trillion is needed to finance infrastructure over the next 15 years. [1] For the world to have a chance of meeting the climate targets set in the Paris Agreement, the vast majority of infrastructure will need to be sustainable and financing opportunities in the transportation industry are increasingly being linked to ESG performance.

Businesses not taking ESG seriously are beginning to lose customers, employees and financing; eventually they will become unviable. Market leaders are taking a strategic response to ESG, changing their products and services, processes, operations and supply chains.“

KPMG (2020). ESG: An introductory guide for businesses

In this context, it is critical for infrastructure companies – and their boards – to have a clear understanding of how ESG considerations can be effectively integrated into corporate strategy and risk management efforts. This includes the integration of ESG factors into strategic decisions, such as those relating to Merge & Acquisition (M&A) and the procurement of suppliers. Adopting an ESG framework is an opportunity to help the community and environment, it’s a means to put values into action throughout the whole life of a project and makes for a better world.

Emerging ESG standards

Currently, there is not an ideal set of standards or framework when it comes to analysing transport infrastructure companies’ performance in ESG. Over the past few years, various guidelines for ESG reporting have emerged, including voluntary standards, reporting frameworks, and national legislation. But these have all introduced slightly different requirements for businesses, leading to calls for a global ESG reporting standard.

A few of the current organisations offering frameworks and standards for assessing sustainability, resiliency and equity in civil infrastructure include:

- The Global Reporting Initiative (GRI) – the world’s most widely used sustainability disclosure standards, currently developing sector specific sets.

- SuRe standards, based in Switzerland, are specific to the infrastructure sector. SuRe is an internationally recognized standard in assessing and certifying sustainable and resilient infrastructure and provides guidance on how to manage sustainability and resilience aspects of infrastructure projects.

- The Sustainability Accounting Standard Board (SASB) framework is a good starting point and has an infrastructure specific set of ESG criteria. The IFRS has a good track record and if they can do for ESG reporting what they did for international financial reporting, then there is room for optimism. 2022 may well turn out to be the beginning of the end for the ESG “alphabet soup.”[2]

For a more in-depth analysis of each of these and more, watch out for our subsequent blog posts.

Need support?

The pace of change around environmental, social, and governance (ESG) risks and performance has elevated organizations’ need to adopt an ESG framework to assess, manage, and disclose ESG positions and commitments around current and emerging regulatory requirements. Don’t get left behind – keep calm and carry on with Phoenix Frontiers and Global Road Links – we can prepare an ESG readiness plan to meet compliance and performance targets and establish a ESG reporting routine for you. As third-party specialists, we can also get out on projects, check supply chain ESG performance and offer solutions on data collection strategies and ways to improve your ESG rating.

Real consideration of the environmental and social risks and impacts is win-win as we balance the conservation of our natural environment with economic development while we are empowered to remember to protect and care for the most vulnerable among us.

If you would like to know more about the infrastructure ESG landscape and what it means for your company, or to help you navigate the ESG maze ahead for your organisation and projects – contact us at [email protected] or [email protected]. Or join us at one of our upcoming ESG webinars and professional workshops at the International Road Federation.